RACETRAC STORE OF THE FUTURE

RACETRAC STORE

OF THE FUTURE

RaceTrac Petroleum is a large chain of gasoline convenience stores in the Southeast United States with over 650 locations in 12 different states. Recently, the rising cost of gasoline and increasing competition has made it more difficult for gasoline convenience stores like RaceTrac to operate solely as a seller of gasoline. Increasingly, the focus has turned towards improving the offerings in the more-profitable convenience store side of the business. However, given the rise of alternative fuel vehicles, gasoline convenience stores may struggle to pull customers into the convenience store side of the business without fuel pumps, especially if such vehicles allow customers to refuel at home. Thus, myself and two other friends challenged ourselves to think of what a convenience store of the future might look like. Specifically, what would it look like to have RaceTrac stores, which typically exist in the perimeter of cities, instead exist in more urban settings?

Group Size

3 members

Length

About 3 months (early 2017)

Role

• Liason between NCR and RaceTrac representatives

• Store UX Design

• Store Design Mockups in Google SketchUp

• Conducting Interviews and Observations

INITIAL RESEARCH

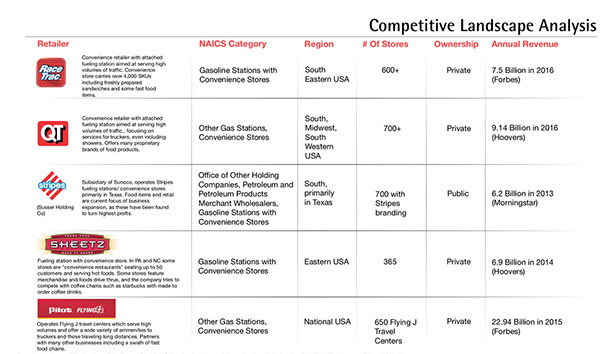

Before we could start designing for a new convenience store design, we realized we needed to understand the landscape of the industry and RaceTrac as a company. Thus, we conducted an analysis of the history of the convenience store industry, looked into RaceTrac’s own history, and conducted a competitive analysis of RaceTrac’s four main competitors.

The origins of gasoline convenience stores could be traced back to 1905-1910, when specialized gasoline service stations that offered both gasoline and repair services started appearing, gaining popularity through the 1910s. These had relatively high customer loyalty as people placed an enormous amount of trust into their local service station that repaired their vehicle and would fill up their tank at that same location as a result. Convenience stores (i.e. stores that did not sell gasoline) appeared much later and became popularized in the 1950s due to the introduction of the interstate highway system and later working hours. It was only until the 1970s that these two started to appear together, as convenience stores started adding gasoline offerings to attract more people into the store. These offerings were unbranded (and usually cheaper as a result) and this, along with the rise of self service stations and increasing gas prices, decreased brand loyalty and made customers more price sensitive. Thus, we realized we were entering into an industry where a lack of customer loyalty was a significant problem, and a focus on improving loyalty could result in massive returns.

Looking into the history of RaceTrac itself, we found that the company had its roots as a gasoline service station in the 1930s, but solidified itself as a convenience store in the 1970s. It became immediately obvious that RaceTrac was a more family-oriented company - descendants of the original founder had roles like CEO and Chairman, along with other powerful roles in the company. This family-centered side of the business was apparent in the relationships it had with its employees, as RaceTrac had earned numerous awards as one of the “Top Places to Work” in places like Atlanta, Dallas, and Tampa Bay. The company had recently underwent a significant transition with its new RT6K store plan in 2012, meant to improve the customer experience through a better lit, more open floor plan with more fresh food offerings and experiences like Swirl World, its frozen yogurt in-store offering.

We also looked into RaceTrac’s competitors, which consisted of companies like QT, Stripes, Sheetz, Pilot, 7-Eleven, and Wawa. A summary of the largest regional competitors is shown here.

NCR & RACETRAC MEETINGS

As we moved forward, we started meeting with representatives both from RaceTrac and from NCR, which manages the payment systems within the RaceTrac stores. These interviews helped provide a bit more perspective on the goals of the company and the direction they were currently moving towards.

We first began by talking to the NCR account representative responsible for working with RaceTrac. From him, we learned about key aspects of the business and goals that the company has moving into the future. Namely, his main goal was to figure out new ways of improving the number of customers pumping gas that also purchased items from the convenience stores. The ratio of gas-plus-convenience store customers in relation to the total number of RaceTrac customers was known as the conversion rate. Given the more-profitable nature of the convenience store side of the business, increasing the conversion rate of those visiting RaceTrac convenience stores by finding ways to encourage customers to enter the store was hugely important for the future of RaceTrac. Additionally, from the NCR representative we learned more about the importance of the family aspect of the company and how this ultimately led into decisions regarding employee training and customer relationships.

Next, I talked to two RaceTrac corporate employees - the VP of Information Systems, Special Projects, and Supply Chain, and the Director of Information Systems. From our interviews, we again learned the importance of conversion for RaceTrac. Here, it was again emphasized how much more profitable the convenience store side of the business was than the gasoline side, which was a well-known fact throughout the industry. Thus, improving sales in the convenience store was seen as a huge opportunity. We learned that gasoline sales were often unpredictable in comparison due to price fluctuations and finding the appropriate reaction in the market. On the other hand, convenience store sales were more consistent, and RaceTrac-branded items and experiences provided the greatest return for RaceTrac. As a result, there was an interest into looking into stores that don’t sell gasoline at all, however, there would need to be substantially more research and brainstorming to figure out ideal layouts and store locations. Additionally, we learned more about the RT6K store redesigns that began in 2012 and the importance of including more unique and RaceTrac-specific experiences within the store.

I also talked to two corporate employees from Branding and Market Research, who were able to talk about the personas that RaceTrac typically designs for and provide more information into RaceTrac’s main customers. For the purposes of our project, we took this information with a grain of salt as they were created over a year prior and didn’t want to skew our own findings based off what they had already defined as their customer segments.

These discussions gave us a much better understanding of the goals of the company and what were seen as areas of opportunity. Still, it was important for us to do our own research and see what we found when observing customers in-store.

OBSERVATIONS & INTERVIEWS

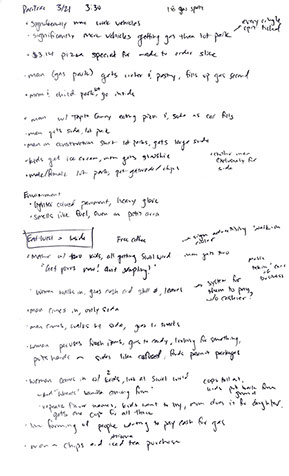

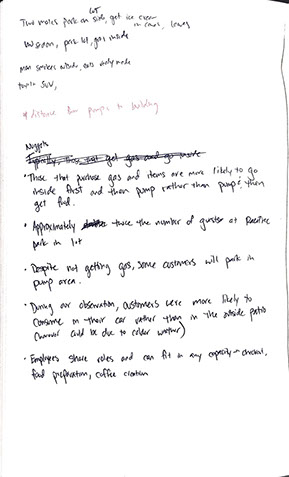

To understand how customers acted in the stores themselves, we completed numerous observation sessions where we would sit in a corner of the store, outside on the dining tables, or in our vehicles and watch customers interact with different areas of the store, both inside and out. In total, we completed seven observations across five different stores in the Atlanta area, each watching customers for about 2 hours. The goal of these observations was to understand customer and employee patterns in their behavior to see if there were any painpoints or parts of the RaceTrac experience that could be improved.

Here are two pages of the notes that I personally took during these sessions. One page is raw notes (left) while the other (right) summarized that day's observations. These, along with tens of other pages of notes, were quickly scribbled and then transcribed after the observation session was complete for easier reference and later use.

Main takeaways from the observations were split into observations regarding the forecourt, or the area where people park or fuel their cards (outside the store), and inside the convenience store itself.

In the forecourt, some observations included:

- Much more than just fueling up vehicles happened in the forecourt than we anticipated. This included work breaks, conducting business inside of their vehicle, and eating inside their vehicle. These actions nearly always happened after purchasing items from the convenience store.

- Commercial vehicles (like pickup trucks) were some of the most common customers and more frequently spent their time lingering at the RaceTrac location, presumably using it as their break from work

- A significant number of vehicles only purchased items from the convenience store as opposed to only fueling up or fueling up and purchasing items.

- A number of customers would use the gas pump area as parking for the convenience store despite never pumping gas, presumably using it as shade cover for their vehicle

- Most customers preferred to eat in their parked vehicle as opposed to using the tables inside the store or the shaded tables outside the store

In the convenience store, some observations included:

- A variety of different special offerings between stores. Some had Made-to-Order meal offerings, a “Beer World” walk-in cooler for alcoholic beverages, and a specialized coffee area (made-to-order drinks), while all stores had a large self-serve beverage area, basic coffee area (drip coffee), and Swirl World (their frozen yogurt offering)

- Heavy rotation of roles between RaceTrac employees to whatever was in demand, floating between roles like checkout, food preparation, coffee brewing, restocking, and cleaning. This meant that while employees were pleasant and friendly, their always-working attitude created a sense of urgency within some of the stores

- While kiosks were available to order food or coffee, some customers preferred to order manually by talking to the employee prepping food, suggesting that it appeared as a hassle or was overwhelming to some customers

- A number of customers came in solely to get a money order, and most customers paid with cash

In addition to observations, we also attempted to interview some RaceTrac customers. However, after attempting to interview customers, we realized that these interviews weren’t particularly helpful as 1) customers originally expected to be able to quickly get in and out of the store, and sometimes left their car open or actively pumping in the lot, and 2) we were unable to get into meaningful depth during the interview out of respect for the customer’s time. However, we were able to interview employees and managers in the stores themselves to learn more about the different jobs, expectations of employees, and customer patterns they’ve noticed.

As a result of these observations and interviews, we were able to start creating customer journey maps, stakeholder relationship maps, and major customer personas that we would be our main artifacts for reference when designing the future RaceTrac store.

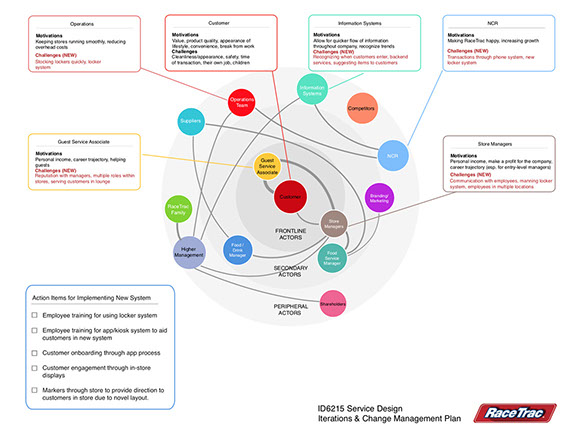

Given our understanding of how the company operated from talking with the NCR and RaceTrac representatives, our observations in the stores themselves, our interviews with those working inside a RaceTrac store, and our own research, we were able to create a stakeholder map. This stakeholder map would allow us to see how each of our changes might impact relationships between people that work at RaceTrac and the customer, and was crucial for eventually constructing a change management plan.

.jpg?crc=3968047305)

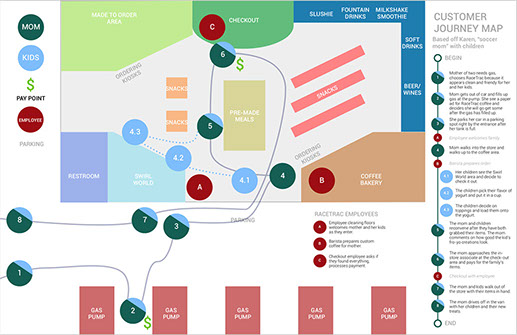

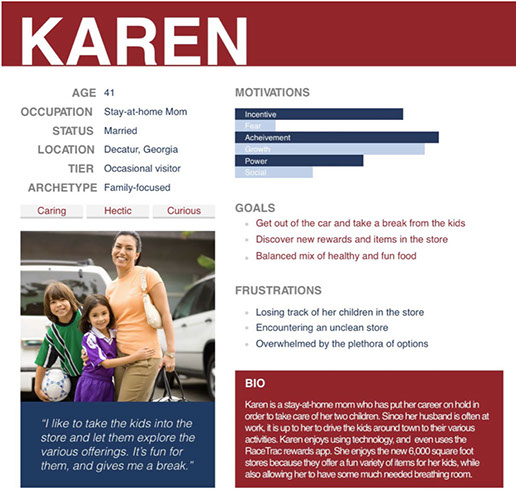

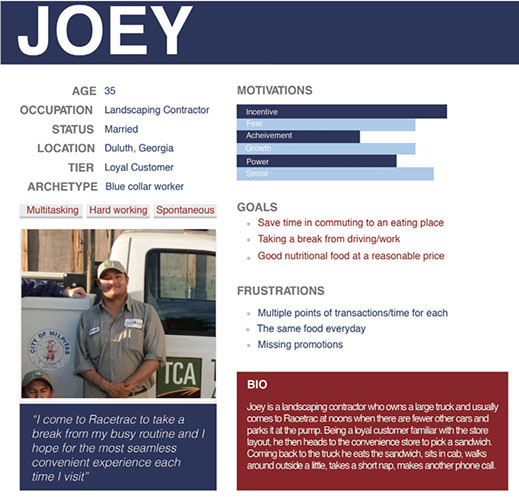

Next, we constructed two personas to help us understand a little bit more about the kinds of customers we were planning on designing for. These original personas consisted of Karen and Joey.

Karen represented a mother with children who typically visited RaceTrac only when stopping for gas. Because she has kids, her family often enjoys getting frozen yogurt from Swirl World. She isn’t particularly loyal to RaceTrac, but appreciates how clean and open the stores are.

Joey was representative of our blue-collar workers that often visit RaceTrac for breaks between work. He’s often on the move, and as a result, utilizes his time at RaceTrac to stop and rest. He doesn’t necessarily get gas every time he is at RaceTrac, but may often just come for lunch or to get a large fountain drink.

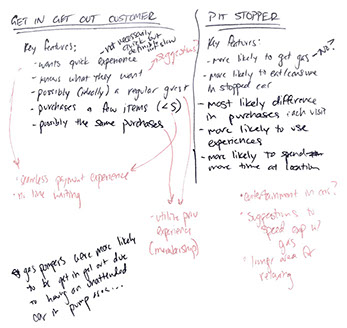

Ultimately, we tweaked these two personas and changed them slightly for our final designs. Karen became our “Get-in-get-out” persona, whereas Joey became our “Pit stopper” persona. Get-in-get-out customers, like Karen, may be busy with a job, children, or are otherwise on the go, and want to get what they need fast and then get out of the store. On the other hand, Pit Stoppers may be utilizing their time at RaceTrac to get away and take a break. Because we were designing for a more urban setting where there were likely to be less blue-collar workers like Joey, we found these changes necessary to predict the kinds of customers we imagined at more urban RaceTrac stores while keeping them rooted in current RaceTrac customers.

We also created customer journey maps of the current RaceTrac flow for each type of customer. Here, I created a mockup of the Karen customer journey map in Sketch:

INITIAL DESIGN

As we moved forward, we created traits for each of these modified customer personas to lead our design. For Get-In-Get-Out customers, their traits were:

- Wants to get in and out of the store quickly

- Typically buys only one or two small items, and is then back on the road

- Doesn’t have the time to wait in line to check out

- Uninterested in specialty items

- Doesn’t want to talk to any one

Pit stoppers, on the other hand, had the following traits:

- Wants a friendly and comfortable place to eat and relax

- Often seeks solace in their car for a quiet place to work

- Desires to kill time while taking a break from work

At this point, we had not yet decided to think about an urban-specific store. When trying to come up with solutions to fit these customers, I sketched out a few ideal flows and tried to remember what their goals and ambitions were, often taking note of what I thought they might benefit from given their pains in the current system:

Ultimately, we came up with a three part solution to solve the needs of each kind of customer. These consisted of:

- License plate recognition to make payment and fueling easier, as well as track your preferences

- “Self-self-checkout”, where the customer would use their own mobile phone for quick purchases

- Entertainment hubs that would welcome customers and display content as they sit in their vehicle

The main goal of license plate recognition was to help create a more personalized shopping experience the second that a customer drives onto the RaceTrac parking lot. From this, we’d know their preferences for fuel or for food, what they typically buy, and payment information.

“Self-self-checkout” had the goal of allowing guests to scan their own items with their phone, paying as they go. This was designed to solve the problem of waiting that particularly plagued Get-In-Get-Out shoppers and clogged lines.

Lastly, the entertainment hub had the goal of providing a place to relax and enjoy offerings in the comfort of a customer’s own car. A hub (essentially a large TV) would exist in front of each parking spot, greeting a customer as soon as the license plate recognition found their plate and information. It would immediately show advertisements of different offerings in the store or suggest items they might like. After purchasing food, customers would return to their vehicle and could use their mobile device to select content on the entertainment hub assigned to their vehicle. Sound would be played over bluetooth or through a low-power radio signal into their vehicle. Ideally, the hub would encourage guests to spend more time at RaceTrac and order more food. The thought was that customers liked spending time in their vehicle as it is their own personal space, so we could use the hubs to connect with customers in their preferred space.

However, upon further investigation, we realized there were a few flaws to our initial designs. There were limitations to “self-self-checkout”, making it difficult for employees to verify that someone wasn’t stealing items from the store. Placing televisions in front of each parking spot was expensive and was subject to issues with glare and visibility, especially during sunlight hours, and may clog RaceTrac locations with people endlessly watching the local sports game in their vehicle. We set out to challenge ourselves even more, and used feedback from our first ideas towards our next iterations and final design.

FINAL DESIGN

As we continued thinking about the problem, we went back to our original discussions and findings. We realized that if fuel was becoming an increasingly less profitable area of the business, what would it be like if we completely removed fueling from a future RaceTrac location? If we did that, then we could have RaceTrac locations on the corners of busy streets in the middle of urban cities, as opposed to on the perimeter.

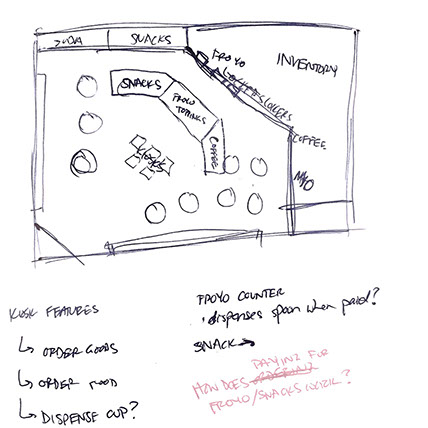

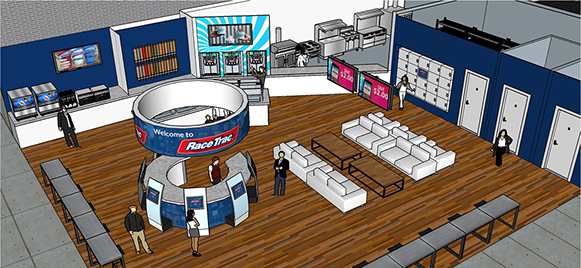

Given this goal, we realized we were likely dealing with significantly less space than was typically in a RaceTrac store, and, as a result, would need an entirely different floor plan. We began thinking of what was critical to the RaceTrac experience, and what were areas that weren’t specific to RaceTrac that we didn’t necessarily need to focus on as much. It became clear to us that what made RaceTrac unique was its family-friendliness and its personalized experiences through offerings like Swirl World, Made-to-Order areas, and their coffee areas.

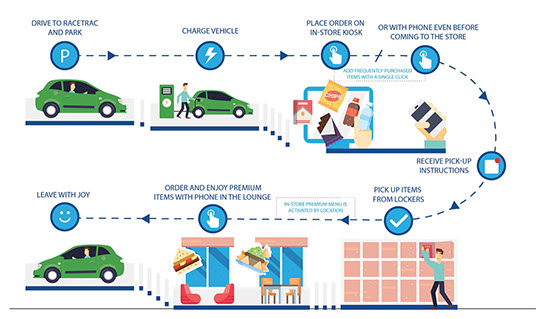

It became apparent that the sale of packaged and bottled items weren’t nearly as unique to RaceTrac as those other experiences, so we decided to condense that area as much as possible. To do this, we decided to push all packaged and bottled items to a condensed inventory space at the back of the store that was out of sight of the customers. If customers wanted something packaged or bottled, they would place an order through their phone or through an in-store kiosk, and the items would be delivered to a series of lockers similar to Amazon Lockers.

By doing this, we created much more space for the unique RaceTrac experiences like Swirl World, coffee area, and Made-to-Order area. In addition, this also cleared up space to create a more welcoming space for the Pit Stoppers to be able to relax and use RaceTrac as more of a destination to go enjoy lunch or stop for coffee, filled with couches and tables rather than aisles of packaged goods.

Given that this was a store of the future, all street parking and any additional parking in the back of the store had charging stations that customers could take advantage of while they were inside the store, serving the needs of Pit Stoppers that wanted to relax during their break but also refuel. If a customer worked down the street and wanted to order something from the Made-to-Order menu, they could easily order food through the mobile app so that it was ready when they arrived in the store. Thus, this helped Get-In-Get-Out customers spend as little time waiting in the store as possible. The mobile app would also be able to suggest items for customers and recognize the kinds of food they normally purchase, expediting the mobile ordering experience.

Any customer that walked into the store without the mobile app would still be able to order food from the kiosks that were manned by an in-store representative. This in-store representative would be able to help any customers that did not want to order through a kiosk, as was seen during our observations. This representative would also be able to provide cups for the coffee and soft drink areas.

Swirl World and the drink areas would remain in the store as before. Additionally, we thought of a “Snack World” concept, where customers could create a customized snack mix from a variety of different kinds of snacks. Like Swirl World, a customer would pay by the weight of whatever was placed into their bag. This would provide another RaceTrac-unique experience that could be highlighted within the store, creating more loyalty with customers.

To demonstrate this idea, we created a new customer journey map to show our ideal flow:

To provide a better visual of the layout of the store, I created a mockup in SketchUp to demonstrate various aspects of the store experience:

Lastly, we created a change management plan using our previous stakeholder map to show how the system might be implemented from a operations standpoint:

Ultimately, my group presented to a RaceTrac corporate employees, NCR representatives, and a number of corporate employees from Walmart, Macy’s, and other major stores. We were pleased with our end design and received positive feedback.

Scroll to the top of the page to view a video of our presentation and learn more about the layout of the store.